As Pakistan’s wealthiest families express interest in acquiring the struggling national flag-carrier, Prime Minister Shehbaz Sharif’s government remains reluctant to sell at least 75% of commercial state-owned entities.

The government aims to maintain control in key sectors such as insurance, finance, road transport, logistics, and oil and gas production. Apart from Pakistan International Airlines (PIA) and power distribution companies, almost all commercial enterprises are excluded from privatisation.

This decision follows internal resistance to government privatisation efforts. Out of 87 eligible commercial entities, only 21 have been recommended for active privatisation, the Privatisation Ministry sources told The Express Tribune. Ministries have excluded 39 companies from privatisation without explanation and have not provided details for another 27 firms. Consequently, the government has selected only a quarter of the entities for privatisation, with some facing challenges due to lack of cooperation from government departments, they added.

Among the 21 state-owned enterprises shortlisted for privatisation by PM Sharif’s government is PIA.

Domestic airlines such as Fly Jinnah, Air Sial, and Air Blue have obtained documents to participate in PIA’s privatisation. Some may form joint ventures with foreign investors or international airlines, according to a Ministry of Privatisation official.

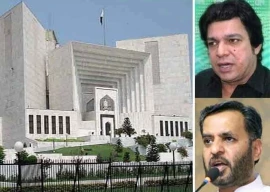

Privatisation Minister Abdul Aleem Khan announced that 10 prospective investors have submitted Expressions of Interest (EoI) for PIA’s privatisation. However, not all investors have submitted documentation yet.

The Privatisation Commission board approved an extension of the submission deadline for PIA divestment interests, accommodating requests from interested parties.

Gerry’s International, engaged in ground handling, has also expressed interest but requires more time for documentation, according to a senior ministry official. Financial advisors anticipate two to three more parties expressing interest soon. Consequently, the board extended the EoI deadline from May 3 to May 18 and established a pre-qualification committee to evaluate prospective investors.

The government has relaxed criteria for bidder participation, primarily requiring a minimum net worth of Rs30 billion. This has attracted interest from Pakistan’s wealthiest families, with no stringent conditions related to aviation industry experience.

The government had advertised to invite investors to acquire majority stakes in PIA a month ago.

Prominent business figure Arif Habib and several players in the cement sector, such as the Tabba family of Lucky Cement, Habibullah Khan of Pioneer Cement, and Bestway Cement and Maple-Leaf Cement, have shown interest and obtained documentation for PIA’s privatisation.

Two business groups from Sindh, Omni Group and D Baloch Construction firm, have also expressed interest, according to privatisation ministry officials. However, no regional airline has yet shown interest in acquiring stakes in PIA.

The government aims to sell stakes ranging from 51% to 100%. However, foreign investors cannot acquire more than 49% and are required to form a consortium with local investors if they wish to invest.

The government has restructured PIA’s balance sheet and assumed its debt, parked in a holding company. It also took responsibility for PIA’s debt from commercial banks.

Although PM Sharif has declared privatisation a priority, government ministries have not fully cooperated with the privatisation ministry, withholding information about potential privatisation candidates.

Of the 87 commercial entities, ministries have shared information for only 60, without explanation for omitting 37 entities. Despite longstanding inclusion on the privatisation list, 15 firms face challenges due to lack of ministry cooperation.

The privatisation ministry recommends prioritising the privatisation of loss-making entities and restricting government involvement to strategic interests.

Due to lack of cooperation from these ministries, the privatisation ministry suggests granting exclusive authority to the Cabinet Committee on SOEs to decide which entities to retain due to their strategic importance.

The Cabinet Division has opposed privatisation of the Pakistan Tourism Development Corporation and Printing Corporation of Pakistan. The Commerce Division has opposed privatisation of Pakistan Reinsurance Company Limited, National Insurance Company Limited, State Life Insurance Corporation of Pakistan, Trading Corporation of Pakistan, and Pakistan Expo Centre.

The communication ministry has opposed privatisation of National Highway Authority and the Pakistan Post Office.

The Finance Division has opposed privatisation of SME Bank Limited, National Bank of Pakistan, Industrial Development Bank of Pakistan, Pak-China Investment Company, Pak-Iran Investment Company, Pak-Libya Investment Company, Pak-Oman Investment Company, Pak-Kuwait, and Pak-Brunei Investment Company. The Finance Division has also opposed privatisation of National Investment Trust Limited.

The industry ministry has also not agreed to the privatisation of National Fertiliser Corporation, Pakistan Industrial Development Corporation, Pakistan Steel Mills, Small and Medium Enterprises Development Authority, State Engineering Corporation, and Utility Stores Corporation.

The information technology (IT) ministry has opposed further off-loading of shares of the Pakistan Telecommunication Limited.

Published in The Express Tribune, May 4th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ